[guestpost]This blog post won 3rd place in the Minnesota Christian Writer’s Guild writing contest. Enjoy![/guestpost]

Money. We place on it our hopes, dreams and security. We desire to have more lining our pocketbooks. But what happens when it’s gone? Those dreams and hopes are flushed away and along with them, our security for tomorrow.

[featured-image single_newwindow=”false”]

I remember standing at the Wells Fargo Bank teller window hearing the words, “We can’t accept your check.” Handing the check back to me she said, “I’m sorry to tell you this, but you’re being foreclosed on.” Talk about a gut punch. Here I was, newly engaged to the love of my life, and soon i wouldn’t have a house for us to live in.

If you’ve been there, or are there, it’s a terrible place to be living. The utter feeling of failure coupled with fear and uncertainty is enough to take the wind out of anyone’s sails.

The good news, there is hope. and I want to give you 6 powerful reasons to overcoming financial fear and help you live with freedom.

1. This is just the beginning. Whether you’ve lost a job, house or find you’re in over your head in debt, there is hope. Remember you’re not the first person this has happened to. Life happens, but when we learn to put our trust in God, he will grant us a peace that surpasses all understanding. We may not know why. But like a butterfly, with every end, there is a new beginning.

2. Time is on your side. Think about a clock. When it’s 10 at night, the sun isn’t shining on you. It’s dark. Even though you may be facing the midnight hour of financial despair, remember the sunshine is coming. Time is on our side. Time heals wounds and time heals credit scores. Sure, you may have to wait to sign that new loan, but someday you’ll be able to sign that paperwork and get that new car. Let time work for you.

3. Put a financial plan into practice. I mentioned above to allow time to work in your favor. How? This is where putting a financial plan in place will increase the funds you have monthly. Even though that home is gone to you, your money isn’t gone. You still make the same amount. Instead of now spending that money on unimportant things, use it wisely. Set up a Roth IRA or a Mutual Fund. Save it away. If you put a financial plan into place, knowing where your money is going–ahead of time–you will find financial peace.

4. Spend less than you make. This is tough for most American families. We think that it’s okay to keep spending, even though the funds are not there. You cannot purchase something you don’t have money for. Once I learned the principle of spending less than I made, I actually had money left over in the bank account. The less you spend, the more you’ll have to save. The more you save, the more you’ll be able to have money work for you, not the other way around.

5. Start saving for tomorrow. One of the hardest things for me to grasp was savings. But once I grasped the simple understanding, I knew it would change my life. So what did I do?

- I started using a cash-based system. Dave Ramsey teaches to buy everything on cash. Don’t use credit cards, only cash. I pulled out a certain amount every month from my paychecks and that was all I used for entertainment, groceries, gas, eating out etc. The rest remained in my checking account. I took my debit card out of my wallet and used the cash for everything. Once that was gone, it was gone until the next month.

- I only used my checking account to pay bills. This is hard for anyone who is a spender. But if we take the time and dedication to only use our checking for bills and savings, we’ll find money left over in our accounts.

- Put 10% of every paycheck into a savings account. This is a must. It’s the only way to build a savings account. In other words, that money is not to be spent. For me, this was difficult, but I noticed more money in my accounts for an emergency that might arise.

- We don’t save for the here and now, we save for tomorrow. I’ve heard Dave Ramsey say; “Live like no one else today, so that you can live like no one else tomorrow.”

6. Live as though nothing happened. Life is hard, but it doesn’t have to stop us from living. Even though my home was foreclosed on, I knew my life could be better simply based on my attitude. Paul said in Philippians 4:6-7; “Be anxious for nothing, but in everything by prayer and supplication, with thanksgiving, let your requests be made known to God; and the peace of God, which surpasses all understanding, will guard your hearts and minds through Christ Jesus.”

We don’t have to fear the future. Jesus told us to let tomorrow worry about itself. If we take the time and put a plan in place, stop spending money, save it away we will see financial freedom when hard times show up.

[reminder]What can you do today to begin saving for tomorrow? What would you add to this list?[/reminder]

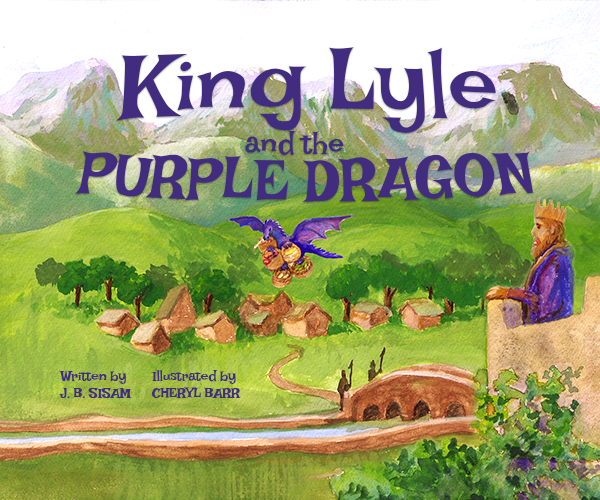

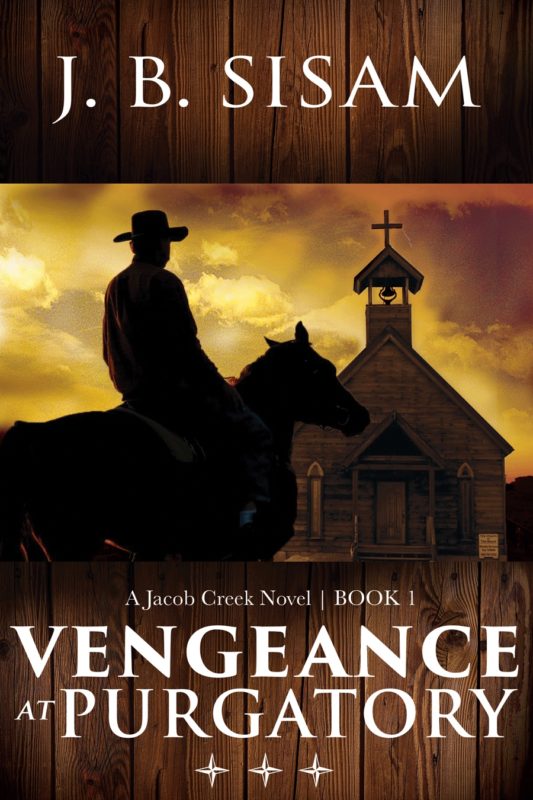

Jason (J.B.) Sisam. Best-selling Amazon author of the Christian Early Reader book,

Jason (J.B.) Sisam. Best-selling Amazon author of the Christian Early Reader book,

LEAVE A COMMENT HERE:

Please note: I reserve the right to delete comments that are offensive or off-topic. Also, this is a clean website, use of any language is not tolerated and your post will be deleted.